$967 SSI Payment November 2025: The SSI program is designed to help low-income individuals who are 65 or older, blind, or disabled cover essentials like food, housing, and clothing. It’s a federal benefit that sends out monthly payments, and the $967 you’ve heard about is the maximum monthly payment for an individual in 2025, adjusted for inflation. But here’s the catch: there’s no special “$967 Payment” happening in November 2025. .

Payments are typically sent out on the 1st of each month, but if that falls on a weekend or holiday, the SSA bumps it to the last business day of the prior month. For November 2025, a Saturday, expect the payment on October 31, 2025. Let’s unpack everything you need to know about this program, from amounts to how to get started.

SSI Payment Schedule for 2025

The SSA keeps things consistent with monthly payments. Here’s the 2025 schedule for key months, adjusted for weekends and holidays:

| Month | Payment Date |

| January | December 31, 2024 |

| February | January 31, 2025 |

| March | February 28, 2025 |

| September | August 29, 2025 |

| October | October 1, 2025 |

| November | October 31, 2025 |

| December | November 28, 2025 |

$967 SSI Payment November 2025

The $967 figure is making waves because it reflects the 2025 maximum SSI payment for individuals, up from $943 in 2024 due to a 2.5% cost-of-living adjustment (COLA). This bump helps keep up with inflation, ensuring your benefits stretch a bit further for groceries, rent, or utilities. For couples where both spouses qualify, the maximum jumps to $1,450 per month.

But don’t get caught up in rumors about a one-time November 2025 Payment. SSI payments are monthly, not a special lump sum. If you’re already receiving SSI, you’ll see the adjusted amount starting January 2025. If you’re new to the program, keep reading to learn how to apply and what to expect.

$2350 Relief for Senior 2025: What Canadians need to know?

$2000 Stimulus Payment November 2025? What’s Real and What’s Just Rumor

SSI Payment Amounts for 2025

The SSI payment you receive depends on your income, living situation, and whether you’re applying as an individual or a couple. Here’s the breakdown for 2025:

- Individuals: Up to $967 per month (or $11,604 annually).

- Couples: Up to $1,450 per month (or $17,400 annually).

- Essential person: If you live with someone who provides essential care (like a live-in caregiver), they may qualify for an additional $485 per month.

Benefits of the SSI Program

The SSI program is a game-changer for millions of Americans. Here’s why it’s so valuable:

- SSI payments are not taxable, so you keep every dollar.

- Unlike one-time relief checks, SSI provides steady, predictable income.

- In most states, getting SSI automatically qualifies you for Medicaid, helping cover medical costs.

- Use the funds for whatever you need—rent, groceries, utilities, or even a small treat to brighten your day.

Who’s Eligible for SSI in 2025?

To qualify for the $967 SSI payment (or any SSI amount), you need to meet these criteria:

- You must be 65 or older, blind, or disabled (as defined by the SSA, which includes physical or mental conditions that prevent substantial work for at least a year).

- Your countable income must be below the federal benefit rate ($967 for individuals, $1,450 for couples). Income includes wages, pensions, or even help from family.

- Your assets (like cash, bank accounts, or property, excluding your primary home and car) must be under $2,000 for individuals or $3,000 for couples.

- You must be a U.S. citizen or a qualified non-citizen living in the U.S.

How to Apply for $967 SSI Payment November 2025

The process is straightforward, but it takes a bit of prep. Here’s your step-by-step guide:

- You’ll need proof of identity (like a driver’s license or passport), Social Security number, income details (pay stubs, bank statements), and resource info (like property deeds or investment accounts). If applying for disability, include medical records or doctor contacts.

- Visit www.ssa.gov and use the SSI application portal. It’s user-friendly and lets you save your progress.

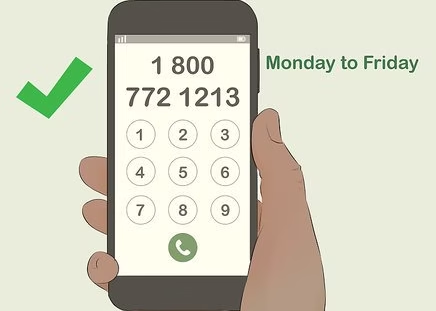

- Call the SSA at 1-800-772-1213 (or 1-800-325-0778 for TTY users) to schedule an appointment.

- Visit your local Social Security office. Find one at www.ssa.gov/locator.

- The SSA typically takes 3–5 months to process SSI applications, especially for disability claims. They’ll review your income, resources, and medical history (if applicable).

- Once approved, provide your bank info for faster payments. Checks by mail are an option but take longer.

£416 DWP Monthly Benefit Cuts 2025, What UK Families Must Do Now, Urgent Guide

FAQs about $967 SSI Payment November 2025

Is there a special $967 Payment in November 2025?

No, $967 is the maximum monthly SSI payment for individuals in 2025. For November, expect it on August 29, 2025, due to the 1st being a Sunday.

How do I know if I’m eligible?

You must be 65 or older, blind, or disabled, with low income and resources. Use the SSA’s Benefit Eligibility Screening Tool at www.ssa.gov.

How long does it take to get approved?

Approval can take 3–5 months, especially for disability claims. Apply early to avoid delays.

Are SSI payments taxable?

No, SSI payments are tax-free.