Partial EPF Withdrawal Rules 2025: The Employees’ Provident Fund (EPF) is a savings scheme designed to secure your retirement, but it also allows you to withdraw a portion of your funds for specific needs. Known as Partial EPF Withdrawal or EPF Advance, this option helps employees cover important expenses like medical bills, education, or home purchases. If you’re an employee or employer, understanding how this works can make the process smooth and stress-free.

Partial EPF Withdrawal lets you take out a part of your EPF savings before retirement for certain approved reasons. Unlike a loan, you don’t need to repay this amount—it’s your money, just accessed early. The Employees’ Provident Fund Organisation (EPFO) sets strict rules on when and how much you can withdraw to ensure the funds are used for genuine needs.

Why Can You Withdraw?

The EPFO allows partial withdrawals for specific purposes, each with its own rules and limits. Here’s a look at the main reasons and conditions:

| Purpose | Eligibility | Withdrawal Limit | Frequency |

|---|---|---|---|

| Marriage (self, child, sibling) | 7+ years of service | 50% of employee’s share + interest | Up to 3 times |

| Education (self or child) | 7+ years of service | 50% of employee’s share + interest | Up to 3 times |

| Medical treatment (self/family) | No minimum service | 6 months’ wages + DA or employee share + interest (lower) | Unlimited |

| Buy land | 5+ years of service | 24 months’ wages + DA | Once |

| Buy/build house | 5+ years of service | 36 months’ wages + DA or total cost (lower) | Once |

| Repay home loan | 10+ years of service | 36 months’ wages + DA or loan amount (lower) | Once |

| Home renovation | 5+ years after construction | 12 months’ wages + DA or cost (lower) | Once |

| Equipment for disability | Medical certificate required | 6 months’ wages or cost (lower) | Every 3 years |

| Unemployment (1+ month) | Unemployed for 1 month | 75% of total balance (25% after 2 months) | Once |

| Natural calamity | Declared by EPFO/Government | ₹5,000 or 50% of employee share (lower) | As notified |

For example, if you’ve worked for 7 years and need funds for your child’s wedding, you could withdraw up to half your savings. If you’re facing a medical emergency, there’s no service requirement, making it easier to access funds.

Partial EPF Withdrawal Eligibility 2025

To qualify for a partial EPF withdrawal, you need to:

- Be an EPF member with an active Universal Account Number (UAN).

- Meet the minimum service years for your withdrawal reason (if applicable).

- Have a KYC-compliant UAN linked to your Aadhaar, PAN, and bank account.

- Use the funds for an EPFO-approved purpose, like those listed above.

About 60% of EPF claims in 2024 were for partial withdrawals, showing how common this option is for employees.

Documents Required

The online process is mostly paperless, but offline or employer-assisted applications may require:

- Aadhaar card copy.

- PAN card copy.

- Bank passbook or cancelled cheque for account verification.

- Marriage invitation or certificate (for marriage withdrawals).

- Medical certificate (for health-related claims).

- Home loan papers or property documents (for housing withdrawals).

- College admission proof or fee receipts (for education).

Check the EPFO portal or with your employer for the exact list, as requirements vary by purpose.

How to Apply for Partial EPF Withdrawal 2025?

You can apply online through the EPFO portal or offline via your employer. Here’s how:

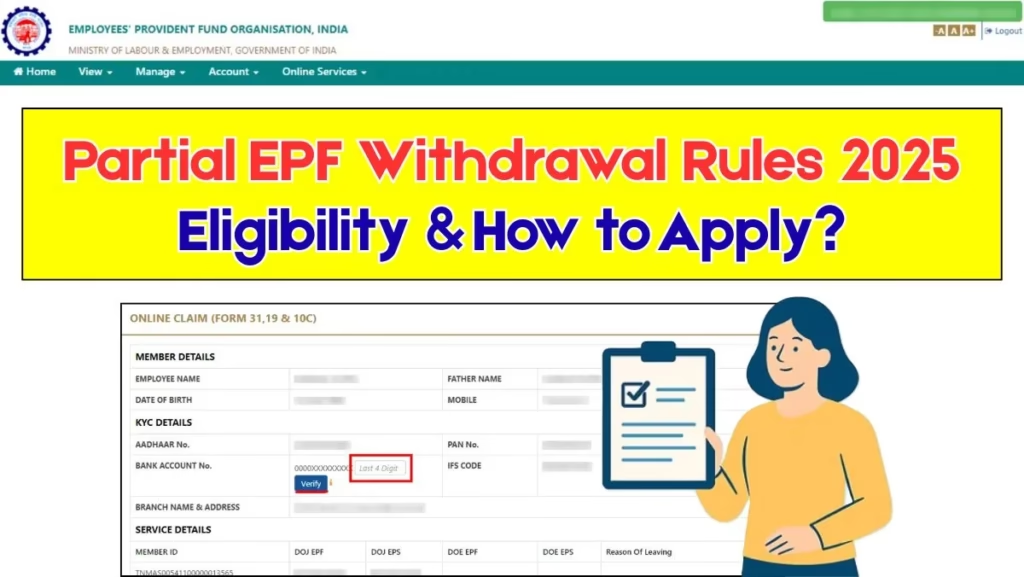

Online Application (UAN Portal)

- Visit the EPFO Unified Member Portal.

- Log in with your UAN and password.

- Go to “Online Services” and select “Claim (Form-31, 19, 10C & 10D).”

- Enter the last four digits of your bank account for verification.

- Choose “Proceed for Online Claim.”

- Select Form-31 for partial withdrawal and pick your reason (e.g., marriage, medical).

- Fill in details, upload any required documents, and submit.

- Track your claim status on the portal using your UAN.

If your Aadhaar is linked and verified, you don’t need employer approval for online claims.

Offline Application (Through Employer)

- Download Form-31 from the EPFO website.

- Fill in details about your withdrawal reason and amount.

- Attach required documents (like Aadhaar or medical certificates).

- Get the form signed by your employer.

- Submit it to the EPFO office where your account is registered.

The online method is faster and more convenient, used by over 70% of applicants in 2024.

Processing Time

Most partial EPF withdrawals are processed in 7–15 working days. Online claims are often faster, taking about 5–10 days, while offline claims may take closer to 15. You can check your claim status on the UAN portal under “Track Claim Status.”

Are Withdrawals Taxed?

Partial EPF withdrawals are usually tax-free, but there are exceptions:

- If you withdraw before 5 years of continuous service, the amount may be taxed.

- Without a linked PAN, TDS (tax deducted at source) is 34.6%.

- With a PAN, TDS drops to 10%.

For example, withdrawing ₹50,000 after 3 years without a PAN could mean losing ₹17,300 to tax. Linking your PAN saves money.

What Employers Need to Do?

Employers play a key role in ensuring smooth withdrawals:

- Verify and update employee KYC details (Aadhaar, PAN, bank) on the EPFO portal.

- Sign and attest offline Form-31 applications when submitted.

- Update the employee’s Date of Exit promptly if they leave the job.

- Guide employees on eligibility and the process to avoid confusion.

In 2024, delays in employer updates caused 10% of claim rejections, so timely action is crucial.

Conclusion

Partial EPF withdrawal is a helpful option for employees facing big expenses, from weddings to medical emergencies or buying a home. By knowing the rules, gathering the right documents, and using the online UAN portal, you can access your funds quickly. Employers can make it easier by keeping records updated and guiding staff. Whether you’re saving for retirement or need cash now, understanding this process helps you make the most of your EPF.