Old Age Security Pension January 2026: Welcome to Canadian seniors or soon to be seniors! You are just journeying towards 65 or have already reached it, then you probably heard about the Old Age Security (OAS) pension, which is the mainstay of a retirement benefit in Canada. It is a monthly check meant to assist you with necessities in life, whether it is the food or the rent or the small things in life that would make retirement more fun. It is still far ahead of time and with 2026 right around the corner, In this article I will give you the whole straight of the OAS pension in January 2026.

What Is the Old Age Security Pension?

OAS pension is a monthly federal government payment provided to seniors of 65 years and above to assist them meet the basic living expenses. OAS is a tax-financed benefit unlike the Canada Pension Plan (CPP which relies on the amount of your contributions on the payroll (in your working years), in order to be entitled to benefit, you must not have ever worked or paid towards a particular fund to benefit. It is meant to be safety net nor every good Canadian who has been unemployed in some period, a teacher, a tradesperson or a stay at home parent.

OAS is but one constitutive constituent of the Canadian retirement income plan, with the others consisting of CPP, the Guaranteed Income Supplement (GIS) of low-income seniors, and your business savings. It is taxable and thus, will have to be reported on your income tax filing, however, it is a good source of revenue that will be adjusted on a quarterly basis to match with inflation. OAS can help you in your financial planning whether you are still working, fully retired or living in the foreign country and 2026 brings some changes, which makes it even better.

Payment Dates for 2026

The next question that will be on your list is when that OAS would hit your banking account. The government is consistent in its timetable where payments reach accounts during the third-to-last business day of the month. If you are registered in direct deposit, you can expect your OAS payment on January 28, 2026, in January 2026. This is the best and quickest mode of getting your money and I can not recommend it highly because when it comes to cheques it can take days or even weeks to be received, more so when there is a postal delay.

Here’s the full OAS payment schedule for the 2026, so you can mark your calendar and plan your budget:

| Month | Payment Date |

| January | January 28, 2026 |

| February | February 25, 2026 |

| March | March 27, 2026 |

| April | April 28, 2026 |

| May | May 27, 2026 |

| June | June 26, 2026 |

| July | July 29, 2026 |

| August | August 27, 2026 |

| September | September 25, 2026 |

| October | October 28, 2026 |

| November | November 26, 2026 |

| December | December 22, 2026 |

Payment Amounts: How Much Will You Get?

OAS is determined by a number of factors such as age, number of years in Canada and income. To keep with inflation, OAS payments are adjusted quarterly with every January, April, July, and October the government reviews these payments basing on the Consumer Price Index (CPI). The good news? When the cost of living reduces then your payments will not reduce but it will remain similar or even rise.

For January 2026, here are the maximum monthly OAS amounts:

- Ages 65 to 74: Up to $742.31 per month, which works out to $8,732.04 per year.

- Ages 75 and older: Up to $816.54 per month, thanks to a permanent 10% boost introduced in July 2022 for seniors 75 and up. That’s $9,605.28 per year.

These are the highest that can get, but the reality is what you have received based on your history of residence and income. The full pension applies to you when you have made 40 or more years in Canada since the age of 18. And in case you have lived here fewer years (at least 10 years in Canada or 20 in Canada living abroad) you also receive a partial pension depending on the number of years you have resided in Canada. As an illustration, you would receive 20/40 th (or half) of the maximum amount in case you lived 20 years in this place.

Your income also matters. Unless you are retired, or have alternative sources of income (such as CPP, RRSP withdrawals, or personal pensions), then you may be charged the OAS recovery tax or a so-called clawback. When the need to retire is 2026 and the net world income would surpass these amounts: in 6574 age bracket, by $93,454, or in 75 years and above, by 157,490, you would pay back 15 cents of any extra income over the limit. Starting with a high income of above 151,668 (between 65 and 74 years old) or 157,490 (over 75 years of age and above), to zero as income increases.

Here’s a table summarizing the OAS amounts for January 2026:

| Age Group | Maximum Monthly OAS | Annual Income Threshold (Clawback) |

| 65–74 | $742.31 | $93,454–$151,668 |

| 75 and older | $816.54 | $93,454–$157,490 |

Eligibility For Get OAS 2026

There are some simple requirements to be eligible to OAS. Here’s what you need to know:

- You should be 65 years or above to begin receiving OAS. Payments start during your 65thmonth of birth but you may delay it until the age of 70 to get a higher monthly payment (which we will discuss further on).

- You must have lived all or an equivalent of 10 years in Canada after your 18 th birthday, or 20 years after your 18 th birthday, whichever is later, in case you are living in Canada at the time of your application, or 20 years, whichever is later, in case you are living outside the country when you apply. In case you lived 40 years in Canada or more since you are 18 years old, you can get the full pension.

- You must be a Canadian citizen or a legal resident (permanent resident or landed immigrant) when you apply. You must have been a citizen or a legal resident of Canada the day before you left Canada, in case you are overseas.

- Even in case you lived or worked in a country that has a social security agreement with Canada (such as the U.S, U.K., or Australia), that time can be included in the count of the residency requirement. Confirm with Service Canada whether the same applies to you or not.

How to Apply for OAS?

To the majority of the Canadians, the process of applying to OAS is as easy as a breeze since Service Canada automatically registers you provided they possess sufficient information provided by your tax returns. A month later, when you are 64 years old, you should receive a letter telling you that you are enrolled and you will receive payments. In case you do not receive this letter, you will have to apply manually. Here’s how:

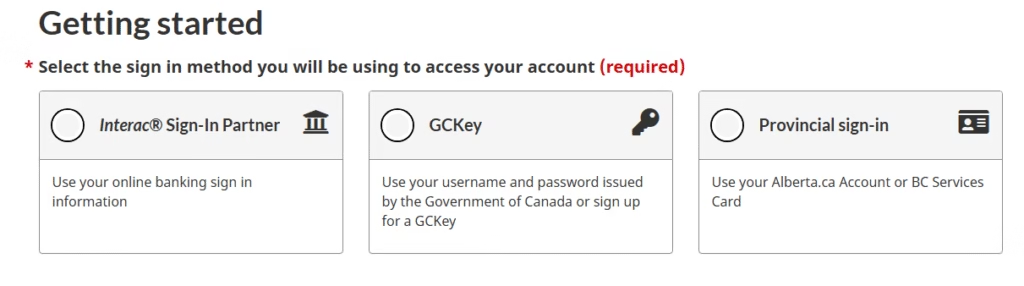

1. Online Application

- The My Service Canada Account can be accessed at canada.ca.

- Go to OAS section and proceed with the application. To open a direct deposit account, you will require your social insurance number (SIN), residence details and bank information.

- This is the most expeditious method of applying should you meet the online requirements (such as creation of a registered CRA My Account).

2. Paper Application

- Make an OAS application form (ISP-3550) downloaded at canada.ca or obtained at a Service Canada office.

- Complete it using your SIN, the history of your residence, and the information about your bank.

- Send it to the Service Canada or go to the local office. The form has addresses listed.

3. Timing

- To make sure you will not be having any delays, apply at least six months before your 65 th birthday (or any date you would like your payments to commence). You can receive retroactive payments of up to 11 months of benefits after 65, however, you will not receive retroactive benefits of any years that you held back.

Checking Your OAS Application Status

Wondering if your OAS application was approved or where your payments are at? Here’s how to check:

1. My Service Canada Account

- Log into your account at canada.ca.

- Go to the “Benefits and Payments” section to see your OAS status, payment amounts, and upcoming payment dates. You can also update your banking or contact info here.

- This is the easiest way to stay on top of things, and it’s secure.

2. Call Service Canada

- Dial 1-800-277-9914 and have your SIN ready. An agent can tell you if your application is approved, pending, or declined, and explain any issues.

- Lines can be busy, so try calling early in the morning or midweek for shorter wait times.

3. Visit a Service Canada Office

- Drop by your local office with your SIN, ID, and any OAS-related letters. Staff can check your status and help with problems, like missing documents or residency verification.

4. Check Your Tax Slip

- Your T4A(OAS) slip, sent out each January, shows your OAS payments for the previous year. This can confirm whether you’re receiving payments and how much.

Service Canada may take a few weeks to confirm your status or income in case you have some application pending. In the case of rejection, you will receive a letter of why, the most popular reasons are lack of residency (less than 10 years in Canada) or omission of information. To be able to appeal to rejection, you have to write to Service Canada within 90 days, provide any supporting documents your proof of residence or a corrected tax return.

What If Your Application Is Rejected or Payments Stop?

If your OAS application is rejected or your payments stop, don’t panic—there are steps you can take:

Common Reasons for Rejection or Stopped Payments

- You have not resided in Canada at least 10 years between ages 18 (or 20 years in foreign countries). Fix this by showing efficiency in residence such as old tax returns, utility bills, etc.

- Eligibility of OAS is usually based on the past year tax returns of your income. You have until April 30, 2025, to avoid interruptions by filing your 2024 taxes.

- In the case of were you to earn more than the excessive allowed by the clawback (93,454 in 2026), you can get less or cease to pay. Evaluate your sources of income and think of putting off OAS when you are still working.

- When you spend over six months outside Canada and you are not subjected to a social security accord, your OAS might be temporarily ceased. Get in touch with Service Canada so that they can prove your status.

- Absence of certain information such as your SIN or banking details can result in rejection. Check and recheck your application and re-apply with the right information.

What to Do?

- In the event that payments were suspended because a tax return was not received, file ASAP by means of the CRA My Account or a tax professional.

- In case you have not submitted all your documents, present the documents and materials that are missing (such as evidence on your place of residence or income to Service Canada).

- Within 90 days of receipt of a rejection letter, write to Service Canada as to why you believe that the decision was improper. Using supporting materials, such as evidence of Canadian residency or fixed tax return.

- Call:1-800- 277- 9914 or visit an office to seek clarification as to why your application was denied or payment halted. They are able to lead you on further actions.

How much will OAS increase in 2026?

According to the adjustments made in the Consumer Price Index, the beneficial OAS increase to January to March 2026 quarter by 0.3% with an increase of 2.0% in the past year, i.e. January 2025 to January 2026.