The Atal Pension Yojana (APY) 2025 is something you need to know about. Launched on 9 May 2015 by Prime Minister Narendra Modi, this scheme is all about helping everyday people, especially those in the unorganized sector, save for a guaranteed monthly pension of ₹1,000 to ₹5,000 after age 60. Whether you’re a shopkeeper, driver, or maid, this plan ensures you’ve got cash coming in when you’re no longer working.

Atal Pension Yojana 2025

Atal Pension Yojana is a pension scheme launched by the Government of India on May 9, 2015, under the leadership of Prime Minister Narendra Modi, named after former PM Atal Bihari Vajpayee. It’s run by the Pension Fund Regulatory and Development Authority (PFRDA) and is all about giving workers in the unorganised sector a safety net for retirement.

Contribute a small amount every month while you’re young (or working), and when you turn 60, you get a fixed monthly pension of ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000, depending on how much you put in. The government guarantees this pension, meaning even if the scheme’s investments don’t perform as expected, they’ll cover the shortfall to ensure you get your promised amount. If investments do better than planned, you might even get a slightly higher pension. It’s like planting a seed today for a steady income tomorrow.

Who’s Eligible for Atal Pension Yojana in 2025?

You must be an Indian citizen. Non-Resident Indians (NRIs) can join if they have an Indian bank account, but foreigners are out. You need to be between 18 and 40 years old. If you’re 41 or older, you can’t sign up, as the scheme requires at least 20 years of contributions before you hit 60. You must have a savings bank account or post office savings account linked to your Aadhaar for auto-debit contributions.

If you are covered by statutory schemes like Employees’ Provident Fund (EPF), Coal Mines Provident Fund, or Assam Tea Plantation Provident Fund, you’re not eligible. This is to ensure APY targets those without existing pensions.

The government co-contribution (50% of your contribution, up to ₹1,000/year) was available from 2015 to 2020 for non-taxpayers who joined before March 31, 2016. In 2025, this isn’t available for new subscribers, but the pension benefits still apply.

Atal Pension Yojana 2025 Benefits

| Benefit | Details |

| Guaranteed Pension | ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000 per month starting at age 60, based on your contributions. |

| Spouse Benefit | If you pass away, your spouse gets the same pension for life. |

| Nominee Benefit | After you and your spouse pass away, your nominee gets the accumulated corpus (up to ₹8.5 lakh for ₹5,000 pension). |

| Tax Benefits | Contributions qualify for deductions under Section 80CCD(1) (up to ₹1.5 lakh) and 80CCD(1B) (extra ₹50,000). |

| Government Guarantee | If investment returns are low, the government covers the shortfall to ensure your minimum pension. |

| Flexible Contributions | Pay monthly, quarterly, or half-yearly via auto-debit from your bank account. |

Objectives of Atal Pension Yojana 2025

The overall intention of Atal Pension Yojana (APY) is that the poor or the low income group citizens of the country can acquire some financial cushioning during their old age. The unorganized sector workers such as daily wage laborers do not have any type of permanent pension scheme and they are left without income security during their old age. Atal Pension Yojana was initiated in order to address this issue.

The Atal Pension Yojana Yojana is a yojana that helps one to save towards retirement and provides a stable income after 60 years of age. It also promotes saving at an early age.

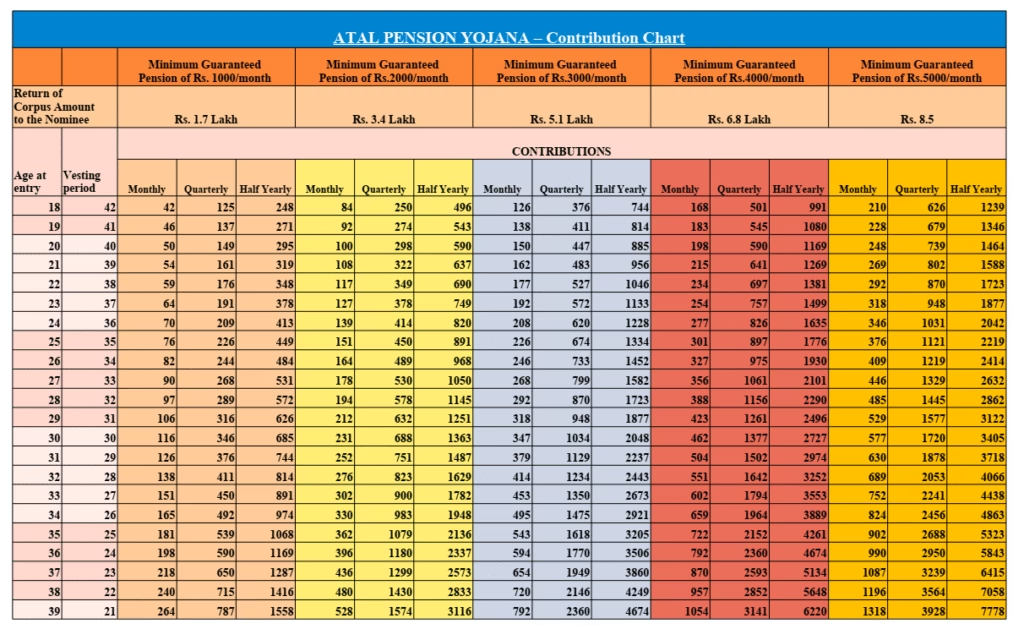

Atal Pension Yojana Contribution Chart

Limitations of Atal Pension Yojana 2025

Most of the eligible citizens, particularly in the rural and backward regions are not aware of the scheme and its benefits. The scheme is open to only those people between the ages of 18 and 40 years as opposed to the older citizens who require pension support as well. The plan has not yet attained the magnitude it is supposed to because of poor financial literacy and confidence in pension plans. The small monthly payments might not be easy to some people with irregular or low income. The maximum pension provided (5000 per month) might not be enough.

Documents Required For Atal Pension Yojana 2025

- Photo.

- Aadhaar Card.

- Bank Account Details.

- Mobile Number.

- Nominee Details.

How to Apply For Atal Pension Yojana 2025

The Atal Pension Yojana is super easy, whether you’re tech-savvy or prefer visiting a bank. Here’s how to do it:

Online Application Process

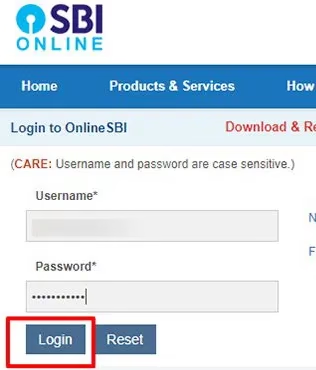

- Log in to your internet banking account (e.g., SBI, HDFC, or ICICI) and search for “APY” or “Atal Pension Yojana”.

- Enter details like your name, Aadhaar number, mobile number, bank account number, and nominee details (spouse is the default nominee if married).

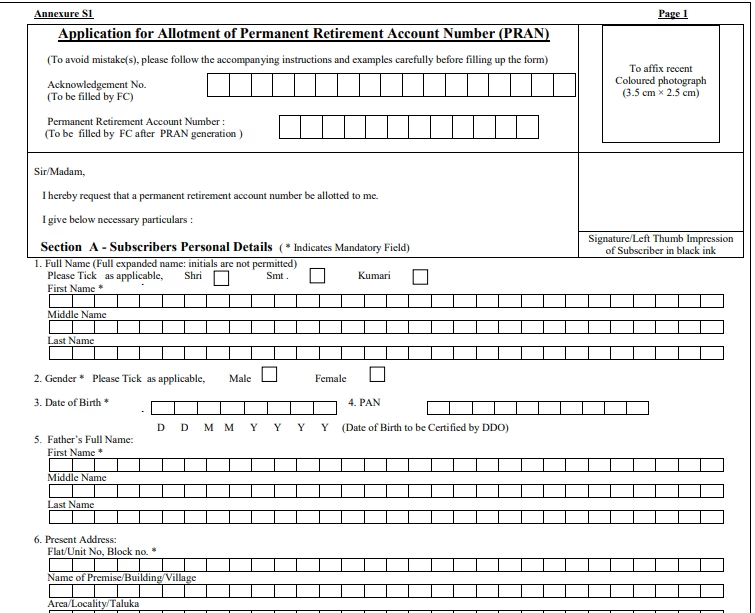

- Agree to auto-debit from your savings account for contributions. Review and submit the form. You’ll get a PRAN (Permanent Retirement Account Number) to track your account.

- Use your PRAN on npscra.nsdl.co.in to check contributions or download statements.

Offline Application Process

Go to any bank or post office that offers APY (most nationalized banks and India Post are enrolled). Then Ask for the APY Subscriber Registration Form. To Provide your Aadhaar number, bank details, mobile number, and nominee details. To Attach copies of required documents (listed below). Then Sign the auto-debit mandate for contributions. The bank will issue your PRAN after processing.

The Atal Pension Yojana 2025 is one such success story by the Government of India which ensures a monthly guaranteed lifelong pension (1,000-5,000) to the unorganised sector workers once they attain the age of 60.

FAQ’s About Atal Pension Yojana 2025

Who is eligible to become part of Atal Pension Yojana (APY)?

The scheme can involve any Indian citizen aged 18 years to 40 years who has a bank account and is not a tax payer to be a member of the scheme.

What determines the amount of the pension?

The amount of the pension relies on the age of the individual who made the contribution and the contribution made. In this case, say the monthly amount of pension required is Rs. 1000 when the age is 18, the amount of contribution required is 42 per month.

What would be the case in case the member passes away before the age of 60?

When a member dies below the age of 60 years, his/her wife is able to make further contributions to the scheme or take the lump sum amount.

Can the amount of contribution be varied?

Yes, members may add or remove the amount of their contributions at least once a year, at the beginning of April.

What will be the situation in case of default in contribution?

A fine is charged in case of default contribution and may vary between 1 per month to 10 per month.