LIC Micro Bachat Plan 751: Life Insurance Corporation of India Limited is offering multiple insurance plans where individuals can invest according to their financial condition. LIC Micro Bachat Plan 751 is a very famous program in the company which is especially designed for low income individuals in the country. The LIC Micro Insurance Plan is offering Life cover as well as the saving facilities to the policy holder. You can ask about the potential of Life Insurance Corporation of India Micro Bachat Plan in this Article where we will share with you the comprehensive overview of the plan including the eligibility criteria, procedure to start the LIC Micro Bachat 751 Plan 2025, Benefits of the LIC Micro Bachat Yojana (Plan 751), how much covers will be provided after death etc.

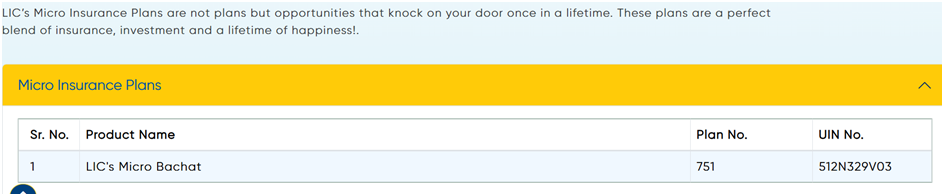

The micro bachat plan of LIC is also known as Table No. 951, earlier 751/851. It is a non linked program where The participating individual is required to pay regular premium until the maturity of the policy. The LIC Micro Bachat 751 policy is offering double benefits where the family of the beneficiary will receive Sum Assured on Death as death benefit and if the applicant completes all the premiums of the policy then he will get a lump sum amount at the time of LIC Micro Bachat Policy maturity.

LIC Micro Bachat Plan 751 Benefits

Death benefit: The company will provide death benefits to the applicant’s family if the policy holder dies during the tenure of policy. According to the official report by the company, if the policy holder dies in first 5 years of starting the policy then the nominee of the policy holder will get Sum Assured on Death. The sum assured term is used by companies to provide a fixed benefit to Nominee in the policy. Usually the sum assured is 7 times of annualized premium. However if the policy holder dies after 5 years of starting the policy then company will provide sum assured + Loyalty to the nominee.

Benefits after maturity: If you complete your entire policy my paying the complete premiums to the company then you will be able to get a refund of your premiums in your bank account directly. So how much amount you invested will be refunded along with additional loyalty if applicable.

Include additional accident benefits: The micro bachat plan is providing only benefits to unfortunate death of the policy holder but will not cover any accidental death benefits. However if you want to include Sach benefits too in your policy then you can add LIC’s Accidental Death & Disability Benefit Rider (UIN: 512B209V02) additionally.

Tax benefits: The government provides tax benefits to the applicant in the policy for maximum 1.5 Lakh according to the tax regime.

LIC 751 Plan Eligibility And Documents

You need to check the following eligibility condition to apply for the Microsoft plan of LIC in 2025:

Age criteria: The age of the applicant should be more than 18 years old while starting the policy in this program however the maximum age of the applicant should not be more than 55 years old to Get entry in this policy. But the applicant should complete the maturity of the policy before the age of 70 to receive the full benefits.

Basic Sum Assured: The company is providing a minimum basic sum assured of ₹50,000 in the multiples of ₹5,000. However investor can opt for the maximum sum assured of ₹2,00,000. After that limit will not increase more than this amount.

Term of plan: The policy is coming with the term of 10 year to 15 years according to the plan opted by the applicant.

How Much Amount To Pay In LIC Micro Bachat Yojana (Plan 751)

The premium of the LIC Micro Bachat 751 program is designed according to the age and life expectancy of the applicant. If you are starting Your policy with the age of 18 then you will need to pay 85.45 per ₹1000 for 10 years, If you are open for 15 year policy then you need to invest 51.50 per 1000. The premiums of the Policy are deducted annually from the bank account of being applicant which is ranging between ₹2,524 per year to ₹17,612 yearly.

How to start the LIC’s Micro Bachat Plan (751)?

If you want to start your micro bachat plan of life insurance company then you can apply through online mode or can contact the policy broker in your circle. The online procedure to purchase a policy is as following: Firstly you need to locate the official website of LIC https://licindia.in/ on this link Where you will find all the details of policies running by the company and you need to search the micro insurance program under the product section.

Create your profile: Now you need to click on buy online link where you need to create your profile on the page by providing your mobile number, email ID, name of the applicant etc so you will able to create user id and password to access the dashboard. Now you need to select your plan and provide your details including bank account information, ID card, address details etc. Once you pay your first premium in the LIC micro insurance plan 2025 program, your policy will start accordingly and you will get all the benefits of the program from the date of starting your first premium.

Key features of LIC Micro Bachat Plan 751

1. No GST – Benefit of Zero GST: This plan is different from all other LIC plans because there is no GST charged on it.

4.5% GST is applicable on other plans: Due to non-implementation of GST in micro savings plan, its premium gets reduced significantly.

2. Available for 18 to 55 years: This plan can be availed by people between the age of 18 to 55 years.

Many other plans are for people up to 50 years of age, but the upper age limit for this plan is 55 years.

3. Benefit of auto cover: If you are unable to pay the premium for any reason, this plan provides you auto cover.

- After paying premiums for 3 years: 6 months auto cover.

- After paying premiums for 5 years: 2 years auto cover.

This means that even if you are unable to pay the premium, the risk cover of your policy will continue.

How to obtain a Rs. 28 plan?

A person who is 18 years of age or older must pay a premium of Rs 51 per thousand for a 15-year plan under this scheme. In contrast, a 25-year-old who enrolls in a 15-year plan will be required to pay a premium of Rs 51.60, and a 35-year-old will be required to pay Rs 52.20 per thousand.

Here is an example to help you understand this. A 35-year-old’s annual premium would be Rs 5116 if they had purchased a 15-year policy with a sum assured of Rs 1 lakh. A loan of up to 70% of the total amount will be available in a current policy, while 60% of the total amount is granted in a paid policy.

LIC Plan 751 Review

Plan for the poor: Due to low premium and minimum insurance amount, this plan is very beneficial for the poor and middle class people.

- Auto Cover: Risk cover continues even without paying premium.

- Loan and Surrender Facility: You can take a loan against the policy or surrender it.

FAQs About LIC Micro Bachat Plan 751

What is LIC Micro Bachat Plan 751?

The LIC microinsurance plan is a non-linked, participating plan that provides low-income people with savings and insurance benefits. It offers a lump sum payment at maturity along with life insurance during the policy’s term.

What is the LIC Micro Bachat Plan 751 Eligibility?

Age range: 18 to 55.

Minimum Sum Assured: ₹50,000

Maximum Sum Assured: ₹2,00,000

For healthy people, no medical test is necessary.

What are the advantages of the LIC Plan 751?

Sum Assured + Loyalty Additions is the maturity benefit.

Death Benefit: Sum Assured or 105% of all premiums paid, whichever is greater.

loan facility following three years.

After two years, the surrender value is applicable.

Are there any bonuses offered by LIC Plan 751?

Yes, Depending on LIC’s performance and the policy year, it provides loyalty additions as a bonus at maturity or early death.

Who should buy LIC Micro Bachat Plan 751?

Low-income individuals

Daily wage workers

Small shopkeepers

Farmers

Housewives