The Government of India has started pm Mudra loan scheme in 2015. The union ministry has announced this scheme to provide loan under Micro Units Development and Refinance Agency Ltd. Which is also known as MUDRA. All the micro, small and medium enterprises can up scale and start their business by using the financial assistance of Mudra loan.

The India is Developing country which is continuously growing. it is important to promote Entrepreneurship Among youth to established new business enterprises in India. the scheme is focusing on Micro, Small and Medium Enterprises- MSMEs. They can apply for Mudra loan from any bank to start and run their small units. This PM MUDRA Loan scheme 2025 will improve the status of job seekers and will promote to build up a new business and provide job to others.

Types of PM MUDRA Loan 2025

Government has created three type of Mudra loan which are suitable according to Enterprises and their needs. you can ask up to 10 lakh from this scheme as a loan.

Shishu Mudra loan

If you are running a small business for want to start a new business where you need up to 50000 Rupees then you can apply for Shishu Mudra loan. this loan will provide you loan amount of Rs 50000 rupees and you will get total 5 years to return this amount to the bank.

Kishor Mudra loan

If you are running small Enterprises or running any manufacturing unit where you need up to 5 lakh rupees then you can apply for Kishore Mudra loan. In the scheme is providing the loan amount from 50001 to 5 lakh.

Tarun Mudra loan

You can ask for a maximum 10 lakh under pm Mudra loan from any bank. If you need more than 5 lakh rupees and maximum 10 lakh rupees then you can apply for Tarun Mudra loan. You will get up to 60 months to return this amount to the bank.

Tarun Plus Mudra Loan

You can ask for a maximum 20 lakh under pm Mudra loan from any bank. If you need more than 10 lakh rupees and maximum 20 lakh rupees then you can apply for Tarun Plus Mudra loan. This is to those entrepreneurs who have already availed and repaid a Tarun loan and require additional capital to make a big expansion.

Features of PM Mudra Loan Yojana 2025

No processing and other charges: Many banks and Enterprises are providing loans to start up a new business but there are some hidden charges for extra processing fees. but pm Mudra loan is not charging any processing fees to the citizens. there are no hidden charges. Citizens can get the loan amount in their bank account with simple procedure.

Women, SC/ST and other challenging categories are getting preference to get pm Mudra loan from the bank. You will get up to 60 months to return your payment to the bank. The interest rest for PM Mudra loan is also low irrespective of any other business loan which is provided by many banks.

Eligibility Criteria for PM Mudra Loan 2025

The government is also providing flexibility under the eligibility to provide pm Mudra loan. Non Cooperative small business segments, Partnership firms, individual firms, small units, small manufacturing units, Shopkeepers, service provider unit, Vegetable and fruit vendors, fruit services unit, truck Operator, repairing units and all other small units are eligible to apply for PM Mudra loan scheme. You can also apply for Mudra loan to purchase taxi, tempo, three wheelers taxi which are running in CNG gas.

Documents Required to Apply for PM MUDRA Loan 2025

- Any government approved ID card including Aadhar card/ pan card/ ration card/ voter ID card/ passport/ driving licence etc.

- Address proof of the candidate. You should submit your latest Electricity bill, Telephone bill, water bill

- Latest 2 recent passport size photographs of application not more than 6 months.

- List of Items to be purchased

- Proof of business. (Registration documents)

- GSTIN

- Registered mobile number and email ID.

- If you belong to any category then you can also attest the related certificate.

Prepare 2 sets of photocopies of all above documents to submit to the bank. You should also carry original documents for verification purposes.

How to Apply for PM Mudra Loan Yojana 2025?

The Mudra Loan Scheme supports and promotes partner institutions in order to achieve development in a sustainable and inclusive way. Detailed instructions for completing the Pradhan Mantri Mudra Yojana Application Form 2025 online are provided below.

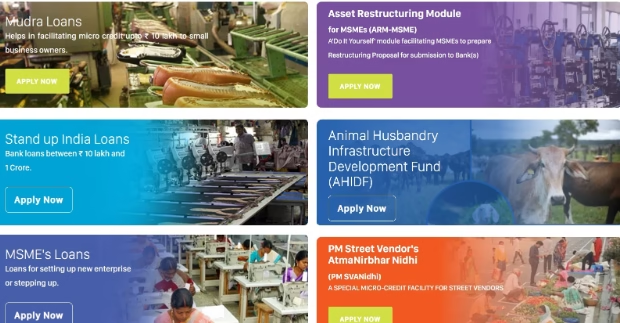

- Go to official PMMY website at https://www.udyamimitra.in/.

- The applicant can click the “Apply Now” link under the “Mudra loans” tab after scrolling down the main page.

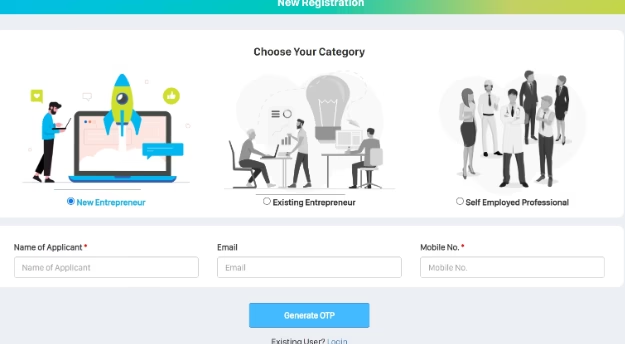

- The PM Mudra Yojana registration form 2025 will show up as follows after you click the link.

- Here enter name of applicant, e-mail ID, mobile number and click at “Generate OTP” button. Next Verify OTP to complete the PM Mudra Yojana registration process.

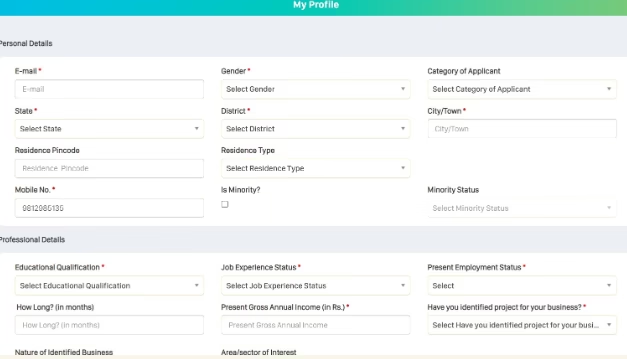

- In the next step, applicants can complete their profile to fill PM Mudra Loan Yojana online application form.

- In order to finish the Pradhan Mantri Mudra Yojana online application process, enter all of your personal and professional information and click the “Submit” button.

The Pradhan Mantri Mudra Yojana (PMMY) has greatly increased financial inclusion and led to the growth of the entrepreneurship at the grass root level in India by giving collateral-free loans to micro and small enterprises. The scheme is still being reviewed, as of 2025 with the loan limit being raised to ₹20 lakh as a way of expanding business.

FAQ’s on PM MUDRA Loan 2025

What is the time taken to receive PM Mudra loan on application?

The usual working days are between 7 and 15 days, depending on the verification of documents and the workload of the banks.

Is it possible to check my Mudra loan status without having a reference number?

There are banks where it is possible to track with the help of mobile number and DOB, however the best is to use the reference number.

Should I take action when my status with Mudra loan is On Hold?

Contact your bank. Probably, it is a sign that it requires other documents to be processed.

I have to visit the bank in order to monitor my Mudra loan?

Not always, most banks are now providing online monitoring through their portal or application.