PM SVANidhi Scheme 2025: The central government is offering business loans to Indian citizens under the PM SVANidhi Scheme 2025. This scheme is designed for micro and medium business startups in India, including the local vendors. So if you are also one of them, then you can check the specific eligibility criteria for the PM SVA Nidhi scheme 2025 and after that can apply online accordingly. We have mentioned all the documents in this article that will be asked for by the government at the time of approving the loan amount.

PM SVANidhi Scheme 2025

The PM SVA Nidhi Scheme was first launched in 2020 during the coronavirus pandemic. It was started to provide financial assistance to the local vendors, including fruit and vegetable vendors, shoe vendors, etc. These beneficiaries can apply for a Rs 50000 instant business loan from the PM SVANidhi scheme 2025, and after that, they will get instant approval on their loan amount. The PM SVANidhi scheme 2025 is open to anyone over the age of 18.

PM SVANidhi Scheme 2025 Overview

| Full Name | Prime Minister Street Vendor’s AtmaNirbhar Nidhi |

| Launched Date | June 2020 |

| Extended Until | March 2030 |

| Loan Amounts | ₹15,000 (1st loan), ₹25,000 (2nd loan), ₹50,000 (3rd loan) |

| Credit Card | UPI-linked RuPay credit card with ₹30,000 limit (after 2nd loan repayment) |

| Cashback | Up to ₹1,600 annually for digital transactions |

| Budget (2025-2030) | ₹7,332 crore |

| Target Beneficiaries | 1.15 crore vendors, including 50 lakh new beneficiaries by 2030 |

| Eligibility | Vendors with Certificate of Vending, ID card, or Letter of Recommendation |

| Key Benefits | Collateral-free loans, 7% interest subsidy, digital payment incentives, skill training |

| Application Portal | pmsvanidhi.mohua.gov.in |

PM SVANidhi Scheme 2025 Latest Updates

The Union Cabinet, chaired by Prime Minister Shri Narendra Modi, has approved the “Restructuring and extension of the lending period beyond 31.12.2024 of Prime Minister Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) Scheme”. The lending period has now been extended until March 31, 2030.

Features of PM SVANidhi Scheme 2025

Considering this, the Ministry of Housing and Urban Affairs sent off a PM SVANidhi conspire to provdes a comprehensive turn of events and the financial upliftment for sellers and the road merchants.

Some features make the scheme more beneficial for vendors or street sellers:

- This scheme is not a medium-based scheme. Instead, it is a central government-based scheme, as it is fully funded and maintained by the central government.

- This scheme has some validity, which means street sellers or vendors can get benefit from this crucial scheme.

- This yojana or government scheme provides an opportunity to get Rs.10,000 as a collateral-free loan, which means the applicant will not need to provide any type of guarantee.

- If the applicant repaid the loan amount on time, they get subsidies as a reward by the central government.

Benefits of PM SVANidhi Scheme 2025

There are three types of loan facilities available in the SVANidhi loan scheme of the Central Government of India, where if a vendor applies for the first time, they can get up to a maximum of 10000 rupees in instant loans. After repayment of the loan amount, applicants can apply for 20000 for the second time, and after paying this amount, applicants will be eligible to get Rs 50000 rupees and a loan.

All the banks that are participating in the SVANidhi loan scheme can provide loan facilities to their customers. Most of the banks are charging up to 12% interest rates from their customers on Pradhan Mantri SVANidhi Yojana. But the government will give the relief of a 7% subsidy on the interest rates, so applicants have to pay only 5% annual interest on the loan amount. It is a very fruitful scheme for all the vendors in India engaged in different businesses.

Eligibility Criteria For PM SVANidhi Scheme 2025

Only Indian citizens are eligible to get the instant PM SVANidhi loan 2025. The age of the applicant should be between 18 years and 60 years at the time of applying. The vendor should be linked with the government and should have a certificate from a board. The vendor should have participated in the local body survey of vendors by the central government. The mobile number of the applicant should be linked with their bank account and Aadhar card also

Loan Amount & Repayment Stages in PM SVANidhi Yojana 2025

The loan amount under PM SVANidhi increases progressively in three stages, depending on timely repayment:

| Loan Stage | Amount | Eligibility Condition |

| First Loan | ₹10,000 | First-time applicant |

| Second Loan | ₹20,000 | After repayment of first loan |

| Third Loan | ₹50,000 | After successful second loan repayment |

Important Details For PM SVANidhi 2025

| Feature | Details |

| Loan Amount | ₹10,000 → ₹20,000 → ₹50,000 |

| Interest Subsidy | 7% per annum (credited quarterly) |

| Loan Tenure | 1 year (renewable) |

| Collateral | None |

| Application Mode | Online & Offline |

| Eligibility | Vendors active before 24 March 2020 |

| Repayment Benefit | Cashback + Access to higher loan |

PM SVANidhi Scheme Challenges

Not every vendor has a smartphone to use the app, and loan approvals can be slow in some areas. But the government’s tackling this by partnering with more lenders and rolling out awareness campaigns. In 2025, expect mobile camps and helplines to make things easier. The focus is on reaching every corner of India, especially smaller towns where vendors might feel left out.

Document For PM SVANidhi Scheme 2025

Applicants have to carry the following documents: At the time of applying for the PM SVANidhi loan scheme 2025:

- Latest passport-size photograph of the applicant

- Bank passbook

- Aadhar card of the applicant

- PAN card of the applicant

- Document related to the vendorship.

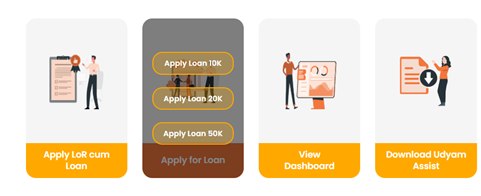

Step-by-Step: How to Apply

Online Application (via PM SVANidhi portal)

- Go to the official website pmsvanidhi.mohua.gov.in

- Then log in to enter username and password

- Select vendor category and enter Survey Reference Number (SRN)

- Fill the form, upload documents

- Submit, loan processed & disbursed post-verification

Offline Application

Go to the nearby bank branch where you hold a savings account. Discuss the PM SVANidhi loan facility & collect applications. Attach documents and submit the form. Post-verification, the loan is credited to your account.

Conclusion

Under the PM SVANidhi Scheme, street vendors are empowered with the loans that do not require any collateral, with interest subsidies and digital incentives as well, thus guaranteeing financial inclusion and the self-reliance. Integration of vendors into the formal economy promotes to the economic stability, safeguards livelihoods, and furthers the objective of making the Atmanirbhar Bharat (Self-Reliant India).

FAQ’s about PM SVANidhi Scheme 2025

Who can apply?

Urban/peri-urban street vendors 18–60 years old, vending since before 24 March 2020, with valid vendor ID or LoR.

How are loans disbursed?

Initial ₹10,000; upon repayment, ₹15,000–₹20,000; then ₹30,000–₹50,000; credit card (₹30,000).

What are the interest rates?

A 7% subsidy is provided; net interest is around 5%. No charges for timely repayment.

Collateral required?

None. EMI repayment only.

Can I apply offline?

Yes, via banks or CSCs. Online application is also available.