Post Office Saving Schemes such as Public Provident Fund (PPF), Senior Citizen Savings Scheme (SCSS) and monthly income schemes (MIS), offer risk-free returns. They also have tax concessions up to Rs.1.5 lakh as specified in section 80C of the income tax act. The interest rates of the Post Office Saving Schemes are revaluated with the coming of Q-1. As of late, the government announced the interest rates on a number of small savings schemes such as PPF and NSC. This is also the case for the first consecutive quarter, which began on January 1, 2026.

According to the new changes, investments in the Sukanya Samriddhi Yojana will earn an interest rate of 8.2 percent, and three-year term deposits will continue to earn 7.1% interest, the same as in the previous quarter.

Post Office Saving Schemes Account

As same as the savings account of other banks, a postal savings account is also manages the money of people. One person can have only one account at a single post office, it can be transferred to another post office if needed. Post office RD scheme 1,000 per month minor can open an account there. A minimum of Rs. 50 is applicable to be remain as a balance if one applicant wants a non-cheque facility. Post office monthly income scheme one can claim a deduction of Rs. 10,000 per year on their total savings account interest.

Types of Post Office Saving Schemes under Postal Bank

- Post Office Saving Account: This works like a normal savings account operated in many banks. There is no TDS. You can open only one account and it is transferable in between the branches.

- Post Office Recurring Deposit: This is a five-year fixed-term monthly investment plan. The interest rate on RD for FY 25-26 is 6.7% currently. It helps the investors who wants to make investment with small amount of money monthly. You can withdraw at least 50% of your deposit after one year of the investment made.

- Post Office Monthly Income Scheme: It offers a fixed guaranteed income if anyone is investing a large amount of money. Minimum limit of investment is Rs. 1000 and maximum is 9 lakhs for single account holders and 15 lakhs for joint account holders. The interest rate is 7.4%. No major tax benefit is there having the scheme.

- Post Office Time Deposit: The features of this account is as same as other accounts but with a speciality that after a certain period of time the time deposit will get matured and then it will be renewed automatically for the same duration. The income tax act’s 80C also applies to the deposit made under this scheme. Interest rates varies year wise.

- Senior Citizens’ Saving Scheme or SCSS: is a program designed specifically for senior citizens. The voluntary retired person can also apply. The limit of investment is up to 30 lakhs. 8.2% is the current interest rate and the maturity of the scheme is 5 years and also the applicant can extend the scheme up to 3 years. This is taxable under 80c.

- PPF or Public Provident Fund: It is a long term investment scheme with a duration of 15 years with an interest rate of 7.1%. Investment limit is up to 1.5 lakhs. It gives the tax benefit of 1.5 lakhs.

- National Savings Certificate or NSC: NSC is a tax benefited risk free saving scheme with a maturity of 5 years having an interest rate of 7.7%. Investments in the Rs. denomination are possible. 100, Rs. 500 or so on. These are transferable.

- SSY or Sukanya Samriddhi Yojana: This scheme is designed to secure the life of the girl child with an interest rate of 8.2%. It will mature after 21 years. Rs.1000 is the minimum investment and maximum of Rs. 1, 50,000. Only the girl can close the account for marriage or studies only. This scheme can also avail a tax benefit under 80C.

- KVP or Kisan Vikas Patra: This is a liquid certificate which doubles the amount in every 115 months. The minimum amount is Rs, and the interest rate is 7.5 percent. 1000. The certificates are easily transferable. The principal amount cannot avail the tax benefit.

Post Office Savings Schemes Overview

| Small Savings Scheme | Interest Rate | Tenure | Tax Deduction on Investment? | Interest Taxable |

| Post Office Savings Account | 4.0% | NA | No | Yes |

| Post Office Recurring Deposit | 6.7% | 5 Years | No | Yes |

| Post Office Monthly Income Scheme | 7.4% | 5 Years | No | Yes |

| Post Office Time Deposit (1 year) | 6.9% | 1 Year | No | Yes |

| Post Office Time Deposit (2 year) | 7% | 2 Years | No | Yes |

| Post Office Time Deposit (3 year) | 7.1% | 3 Years | No | Yes |

| Post Office Time Deposit (5 year) | 7.5% | 5 Years | Yes | Yes |

| Kisan Vikas Patra (KVP) | 7.5% | 30 Months Lock-in period | No | Yes |

| Public Provident Fund (PPF) | 7.1% | 15 Years | Yes | No |

| Sukanya Samriddhi Yojana | 8.2% | 21 Years | Yes | No |

| National Savings Certificate | 7.7% | 5 Years | Yes | No |

| Senior Citizens Savings Scheme | 8.2% | 5 Years | Yes | Yes |

CM Kisan Kalyan Yojana 14th Installment 2026 Coming Before Shivratri

Latest Update on Post Office Saving Schemes 2026

The Post Office Saving Schemes 2026 still provide returns that are stable and supported by government as well as easily accessible by all types of depositors with the central government maintaining the same interest rates in the first quarter of January 2026. This implies that investors will be assured of the rates which have already been announced such as 8.2% in Sukanya Samriddhi Yojana and Senior Citizens Savings Scheme, 7.1% in Public Provident Fund and 3-year Time Deposit, 7.7% in National Savings Certificate, and 7.4% in the Monthly Income Scheme.

Every scheme will serve different types of financial requirements- daily savings as well as incomes per month to future plans of children or retirement. Notably, PPF, SSY, NSC and 5 years Time Deposits offer good tax advantages under Section 80 C, where tax free interest is paid in PPF and SSY and therefore they are very attractive as an investment in saving taxes. Kisan Vikas Patra maintains the same rate of 7.5% and the special doubling option- it is perfect to those who are oriented towards long-term capital-growth.

Important Dates for 2026

| Event | Date | Details |

| Q1 Rate Review | January 1, 2026 | Current rates (Jan-Mar) set at stable levels like 8.2% for SCSS. |

| Q2 Rate Review | April 1, 2026 | Upcoming announcement—watch for potential hikes. |

| Q3 Rate Review | June 1, 2026 | Upcoming announcement—watch for potential hikes. |

| PPF Maturity Extensions | Anytime after 15 years | Flexible rollover options effective throughout 2026. |

| SSY Account Opening Date | Anytime for a Girl Child below 10 years | Annual deposit limit resets April 1. |

How to Invest in Post Office Saving Schemes 2026

- To choose the scheme which suits your objectives either in the short run or long run or on behalf of your children.

- Go to your nearest post office. These Post Office Saving Schemes are provided in most branches even in small towns.

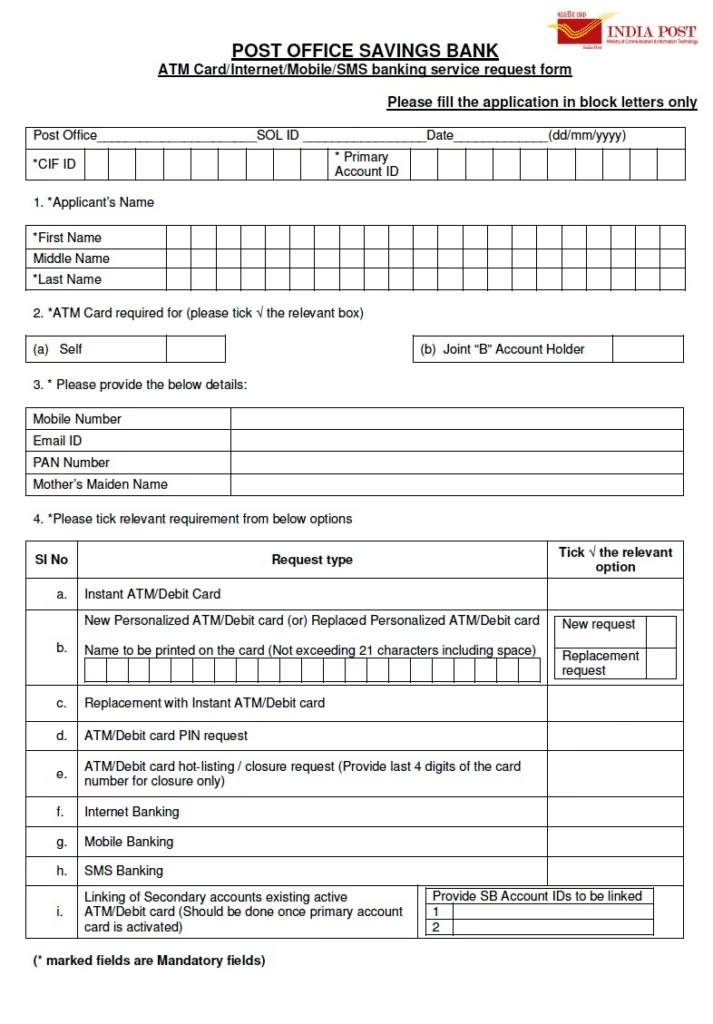

- Thereupon complete the application form of your selected scheme. You will be required to give basic information such as your name and address and the bank account.

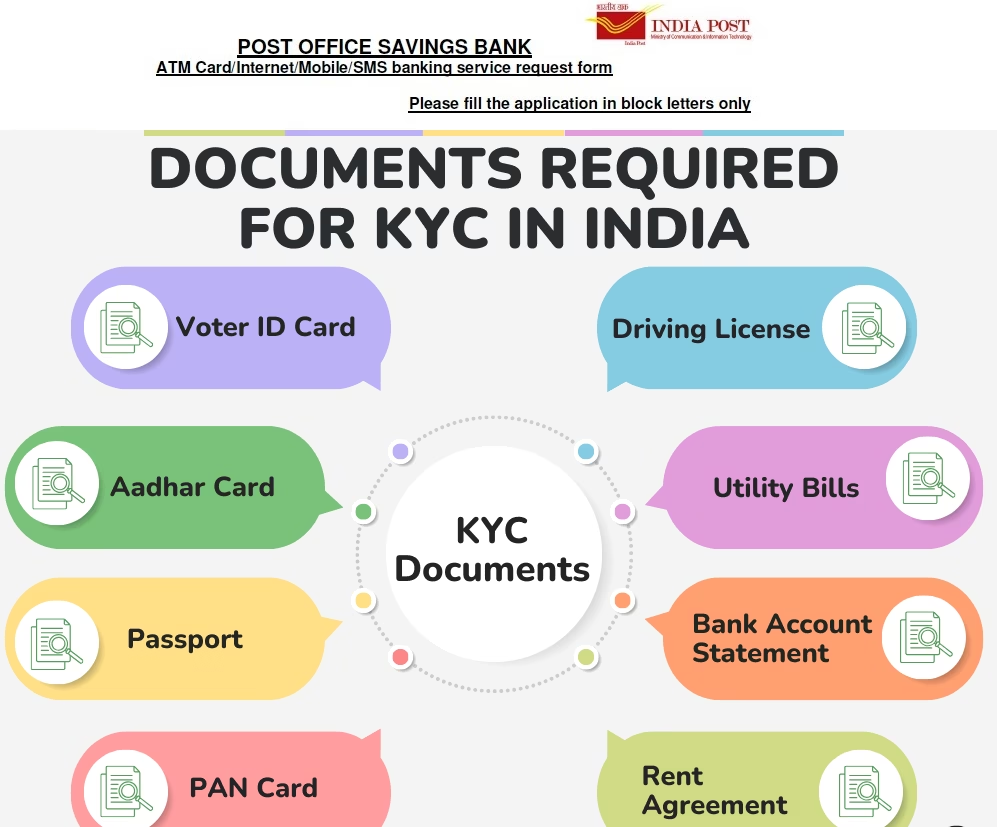

- To Submit the document your Aadhaar card, PAN card and a photo of passport size. There are schemes which might demand other evidence such as age evidence in case of SCSS.

- In order to deposit your money, You can pay through cash, cheque, or demand draft. Digital payments are also accepted in some of the post offices.

- Go the Your Passbook on your account is opened, you will get a passbook in which to record your investments.

- Many schemes have now gone online and can be accessed via the mobile application or the India Post site, and hence you can check your balance at the comfort of your home.

Benefits Of Post Office Saving Schemes

It can be easily applied in the postal saving schemes by investing. It needs a less paperwork. These savings are able to invest in things that will guarantee the client a certain amount of returns since the schemes are government controlled and thereby regulated. The schemes are flexible and do not require much complexity hence they can be taken by both the investors of the rural and urban regions. The Post Office investing schemes is more futuristic and it is intended to serve long term advantages. Such gains are being used as good retirement or pension plans with up to 15 years to invest in a PPF account.

The investors can diversify their portfolios without risking anything and also they are receiving stable returns out of it. They charge interest rates of between 4 and 8 which is also risk-free and very competitive to the banks.

Schedule Fee of Post Office Saving Schemes

The schedule fee of Post office Investment Schemes are as follows:

| Duplicate Passbook Issue | Rs. 50 |

| Deposit Receipt or Issue of Statement of Account | Rs. 20/case |

| Issue of Passbook in Lieu of Lost or Mutilated Certificate | Rs. 10 per registration |

| Cancellation or Change of Nomination Charges | Rs. 50 |

| Account Transfer Fee | Rs. 100 |

| Pledging of Account | Rs. 100 |

| Issue of Cheque Book (for Savings Bank a/c) | Nil: Up to 10 leafs in a calendar yearRs. 2 per cheque leaf thereafter |

| Cheque Dishonour Charges | Rs. 100 |

Documentation For Post Office Saving Schemes

In order to open a postal saving scheme, the applicant must produce the following documents in front of the bank. The completed or filled form, the A KYC form, the Aadhaar card of the applicant, the PAN card of the applicant, Passport size photos, residence proof, nomination form and proof of birth in case of a minor are the documents.

Investment Process: Post Office Saving Schemes

In case you wish to invest in either of the schemes then visit your closest post office branch and selected the scheme you wish to invest. Take the account opening form and fill it. Add the KYC proofs and other documentation. So open your account, deposit the minimum under the scheme and select your scheme wisely making the benefits known to you or compared with each other.

FAQs about How to Invest Post Office Saving Schemes

Is Post Office Saving Schemes is safe?

Yes, absolutely government-guaranteed, no tax on your principal.

Can I open Post Office Saving Schemes online?

Partially, use the India Post portal for some, but visit a branch for full setup.

Which Scheme is best for taxes under Post Office Saving Schemes 2026?

PPF and SSY offer full tax-free returns under 80C.

Do rates change often?

Reviewed quarterly, but usually stable. Check official sites.