Social Security Retirement Age 2025: Hello Americans, there are some exciting news here for you. Look at it. The SSA has increased the Full Retirement Age to 67 for the people who born in 1960 or later. you will able to find out the changes happened so that you can plan your retirement accordingly. In this article we are also covering how retiring early or later impacts your benefits, and what future changes could be expected.

On the market that the Social Security Administration officially raised the Full Retirement Age to 67 for those born in 1960 or later. So, this adjustment is done as an impact of gradual change that started with the 1983 Social Security Amendments, which aimed to account for longer life expectancies and maintain the program’s financial health. This information is important for those retirees who are planning to have it. It is important to understand these changes for better financial planning.

Social Security Retirement Age 2025 – Overview

The Social Security Administration (SSA) has announced that the full retirement age is inching up in 2025. This isn’t a brand-new thin, Congress decided back in 1983 to gradually raise the FRA to keep up with longer life expectancies. People are living longer, so the system needs to adjust to stay sustainable. For 2025, the change born between May 2, 1958, and February 28, 1959, born after that. The FRA isn’t a one-size-fits-all number anymore it depends on your birth year.

If you were born in 1958, your FRA in 2025 will be 66 years and 8 months. Born in 1959? It’s 66 years and 10 months. And born in 1960 or later, your FRA is a flat 67 years. This gradual increase has been happening for a while, but it’s worth paying attention to because it directly impacts how much you’ll get from Social Security and when you should start claiming benefits.

$1702 Stimulus Check 2025: Eligibility, Payment Dates and Latest Updates

Florida SNAP Increase 2025: When will you receiving additional benefits from SNAP Florida?

How to Apply For Social Security Retirement Age

- You can check your earnings record and estimated benefits by creating an account on the SSA’s website (ssa.gov).

- You can apply as early as three months before you want your benefits to start.

- You’ll need your Social Security number, birth certificate, and proof of citizenship or legal residency. If you’re applying for spousal or survivor benefits, you might need marriage or death certificates.

- The easiest way is to apply online at ssa.gov. You can also call the SSA at 1-800-772-1213 or visit a local office (appointments are required in 2025 for in-person visits). Online is usually the fastest option, and you can do it from your couch.

- Once you apply, it can take a few weeks to a few months to get approved, depending on how complete your application is.

Other Changes in 2025

While we’re on the topic, Social Security isn’t just tweaking the FRA. There’s also a cost-of-living adjustment (COLA) set for 2025, a 2.5% increase to help benefits keep up with inflation. It’s smaller than the 3.2% bump in 2024, but it’ll still add a little extra to your monthly check. For example, if you’re getting $1,500 a month now, the COLA could boost that to about $1,537.50 in 2025. Not huge, but every bit helps.

Another change: the maximum earnings subject to Social Security taxes will rise to $176,100 in 2025, up from $168,000. If you’re still working and earning a high income, this means a bit more of your paycheck will be taxed for Social Security.

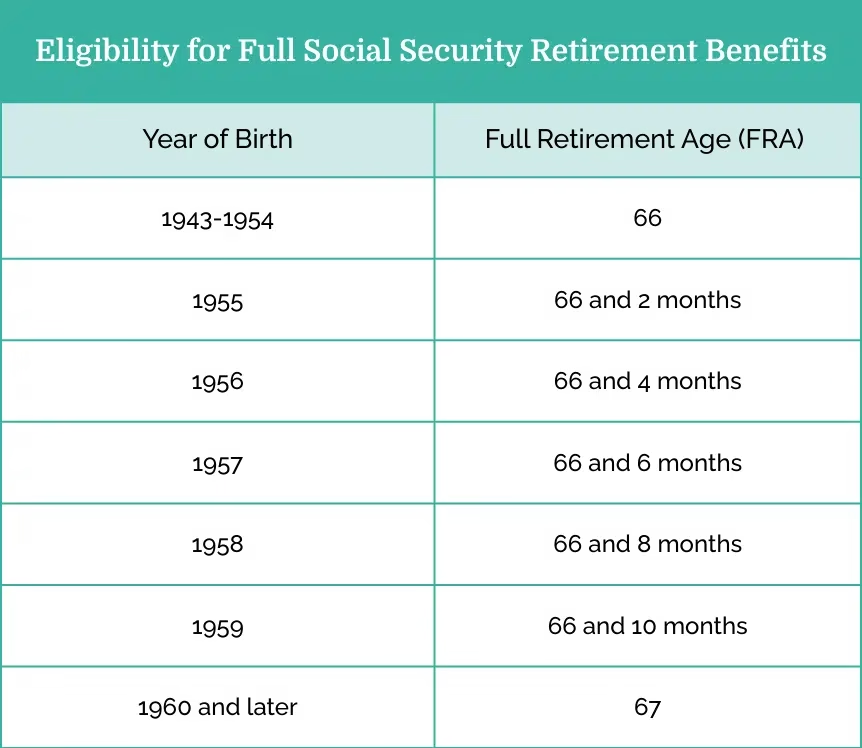

Full Retirement Age by Birth Year 2025

To make this easier, here’s a table showing the FRA based on your birth year:

| Birth Year | Full Retirement Age |

| 1955 | 66 years and 2 months |

| 1956 | 66 years and 4 months |

| 1957 | 66 years and 6 months |

| 1958 | 66 years and 8 months |

| 1959 | 66 years and 10 months |

| 1960 and later | 67 years |

Social Security Retirement Age – Eligibility

FRA, but are you eligible for those full benefits? Here’s what you need to qualify:

- Work Credits, you earn one credit for every $1,810 in earnings, up to four credits per year. Most people who’ve worked steadily will have this covered.

- You must reach your FRA to get 100% of your benefits. Claim earlier, and your payments are reduced; claim later, and they increase.

- You need to be a U.S. citizen or a legal resident with enough work history in the U.S.

- You have to apply for benefits, Social Security doesn’t just send you a check automatically. You can apply online, by phone, or at an SSA office.

Payment Schedule for September 2025

When do the checks (or direct deposits) roll in? If you’re already getting Social Security, payments are based on your birth date. Here’s the schedule for September 2025:

| Birth Date | Payment Date |

| 1st–10th | September 10, 2025 |

| 11th–20th | September 17, 2025 |

| 21st–31st | September 24, 2025 |

$1390 Stimulus Check September 2025 Payment Dates, Eligibility & Latest Updates

Social Security Payments September 2025: Who Gets Paid & How Much? Full Schedule

Social Security Retirement Age – Features

Social Security comes with some handy features to make life easier for retirees:

- Each year, benefits get a boost to keep up with inflation. For 2025, the COLA is estimated at around 2.5%, so your payments might increase slightly compared to 2024.

- Payments go straight to your bank account, making it secure and hassle-free.

- Depending on your income, part of your benefits might be tax-free. Check with a tax pro to see how it affects you.

- If you pass away, your spouse or dependents might be eligible for benefits based on your record.

- The SSA’s website (ssa.gov) lets you check your benefits, estimate payments, and apply all from your couch.

FAQs about Social Security Retirement Age

Can I get Social Security if I’m still working?

Yes, but if you’re under your FRA, earning over $23,280 in 2025 could reduce your benefits temporarily.

What’s the maximum benefit in 2025?

For someone claiming at FRA, the max monthly benefit is around $3,940. At 70, it could hit $5,000 with delayed credits.

Do I have to take Social Security at 62?

Nope! You can start anytime between 62 and 70. Waiting until FRA or later means bigger checks.

How do I know my FRA?

Check your birth year against the SSA’s chart. For most folks in 2025, it’s between 66 and 67.