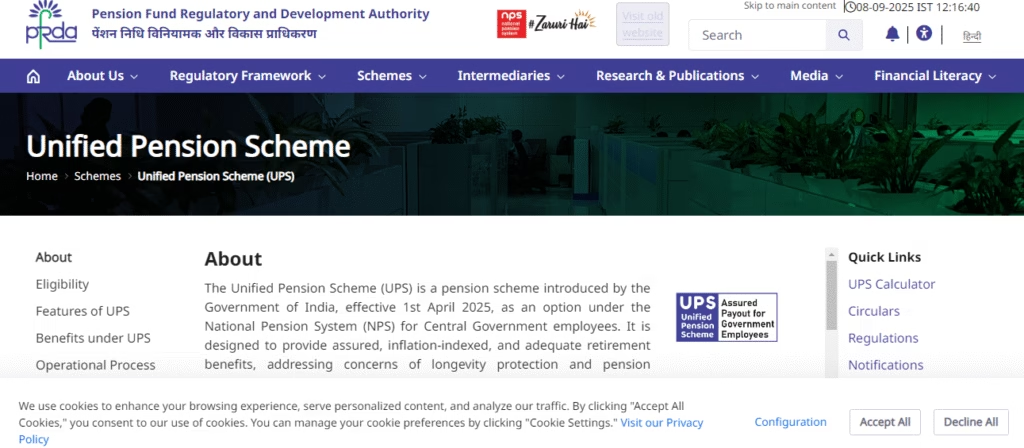

Unified Pension Scheme 2025: The Central Government has recently taken a very important and rare decision to make the Unified Pension Scheme 2025 equivalent to the National Pension System in terms of tax benefits. That is, now all the central employees coming under UPS will get the same tax exemption and contribution benefits which were available only to NPS holders. This step taken by the Central Government will not only prove to be a great step towards bringing transparency and equality in the pension system, but due to this step, the employees will get the benefit of guaranteed pension security as well as tax savings.

Unified Pension Scheme 2025 Overview

| Name of Scheme | Unified Pension Scheme (UPS) |

| Launching Date | 24th August 2024 |

| Notification Date | 24th January 2025 |

| Implementation Date | 1st April 2025 |

| Beneficiaries | Central Government employees, including the newly joined and existing NPS subscribers. |

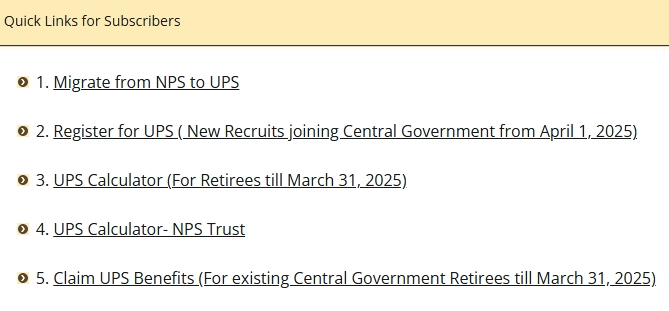

| Last Date for Switch from NPS to UPS | 30th September 2025 |

| Contribution for Employee | 10% of basic salary + DA |

| Contribution for Employer | 18.5% of basic salary + DA |

| Minimum Service | 10 years for minimum pension and 25 years for the full pension. |

| Amount of Pension | Pension of 50% on the average basic pay over the last 12 months before retirement for the employees having at least 25 years of service. |

| Rs. 10,000 monthly upon superannuation after at least 10 years of service. | |

| Gratuity | Eligible for retirement and death gratuity |

| Partial Withdrawal | Allowed after 3 years for specific reasons |

| Official Website | www.npscra.nsdl.co.in |

UPS Pension Scheme 2025 Eligibility

- Existing Central Government Employees existing Central Government employee covered under the NPS and is in the service as on 1st April 2025.

- Newly Joined Central Government Employees is newly recruited in the Central Government services, joining service on or after 1st April 2025.

- A Central Government employee who was covered under the NPS and who has superannuated, voluntarily retired or retired under the Fundamental Rules 56(j) on or before 31st March 2025.

- The legally wed spouse of a retired or superannuated Central Government employee being a NPS subscriber and deceased before exercising the option for UPS.

Unified Pension Scheme Details

| Particulars | Details |

|---|---|

| Monthly Amount | ₹10,000 |

| Disbursement Start Date | April 15, 2025 |

| Frequency | Monthly (disbursed on the 15th of each month) |

| Payment Mode | Direct Benefit Transfer (DBT) |

| Account Requirement | Savings bank account linked to Aadhaar |

| Support Channels | Toll-free helpline and online grievance redressal portal |

Who are not Eligible for the UPS 2025?

The following Central Government employees will not be eligible for UPS:

- Employee superannuating or resigning before 10 years of the service.

- Employees who are removed from service.

- Employees who are dismissed from service.

Unified Pension Scheme 2025 Benefits

| Benefits | Details |

|---|---|

| Enhanced Pension Amount | ₹10,000 per month for improved financial security |

| Digital Processing | Fully digital onboarding with automated verification for seamless experience |

| Consistent Disbursement | Fixed monthly payments on the 15th for reliability |

| Transparent System | Aadhaar-linked with Direct Benefit Transfer (DBT) for accountability |

| Inclusivity | Special provisions for widows, differently-abled, and single elderly persons |

Reason Behind the UPS Pension Scheme 2025 started

The government decided to start the Unified Pension Scheme 2025 in April 2025. The main objective of starting this Unified Pension Scheme 2025 has been started as an alternative pension scheme for new recruitment and employees already covered under NPS so that the guaranteed pension system can be re-implemented. Unified pension scheme details, the sole objective of the Central Government was to provide pre-determined and predictable pension to all the employees which is more clear and reliable than the market based NPS. As we all know, all the employees involved in NPS get pension based on market returns, whereas in UPS, 50% pension is guaranteed. However, special conditions have been determined for this in which every employee will have to complete a service tenure of at least 25 years.

As we said, to get a guaranteed pension under Unified Pension Scheme 2025, employees will now have to give at least 25 years of service in the department. Employees who have served for 10 years in the department will definitely get a 10000 pension monthly. At the same time, employees who have served for 25 years will be given 50% pension guaranteed. Apart from this, a big change has also been made in the contribution structure under UPS and NPS and to fill the gap of this change, the government has now decided to link the tax benefits of NPS with UPS. Where there will be 10% contribution from the employee and the government will contribute 18.5% from its side. Whereas in NPS, only 14% contribution was given by the government, but now due to more contribution from the government, the corpus fund will become bigger.

SIP and SWP Schemes: (Systematic Investment Plan) And STP (Systematic Transfer Plan) Investment

Make in India scheme 2025: Government’s New Push Towards a Global Manufacturing Hub

Exemption Notification Issued by Ministry of Finance and Provisions Under the Exemption

For the information of the readers, let us tell you that the Finance Ministry recently issued a release on 4 July 2025, in this release, the government said that tax exemption will be implemented in UPS like NPS. The following provisions will be ensured under this tax exemption:

Under the old tax rules, 10% of the employees’ contribution or up to Rs 1.5 lakh under section 80ccd will come under the tax exemption limit. Under section 80ccd 1b, tax exemption will be available on additional 50000. Under section 80ccd 2, the government will contribute up to 14%. However, in UPS, the government will contribute 18.5%, due to which the employees will get a tax benefit of 18.5%.

Compare with Other Pension Schemes

| Scheme Name | Monthly Pension | Eligibility Age | Mode of Payment | Remarks |

|---|---|---|---|---|

| Unified Pension Scheme 2025 | ₹10,000 | 60 years | Direct Benefit Transfer (DBT) | Uniform coverage across India |

| IGNOAPS | ₹200–₹500 | 60–80 years | Cash or DBT | Combined Central and State contributions |

| State-level Old Age Pensions | ₹400–₹1,000 | 60+ years | Varies by state | Varies based on state-specific policies |

| EPFO Pension | ₹1,000–₹7,500+ | 58+ years | Direct Benefit Transfer (DBT) | Contribution-based pension |

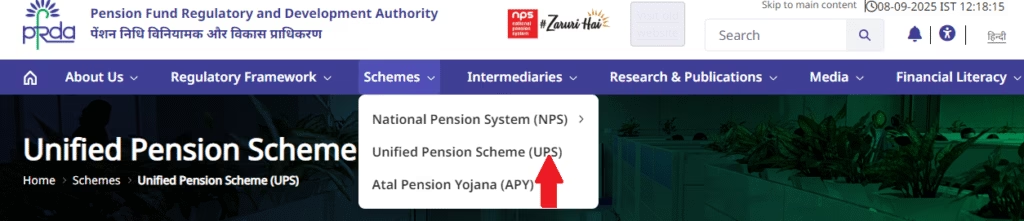

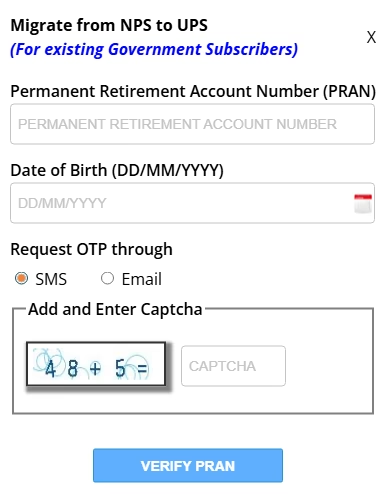

How to Apply for Unified Pension Scheme?

Eligible Central Government employees can apply for Unified Pension Scheme by the following steps.

- Visit to the Protean website.

- Click on the ‘Unified Pension Scheme’ option.

- Select ‘Migrate from the ‘NPS to UPS’ if you are the existing member of NPS or ‘Register for UPS’ option if you are a newly recruited employee joining the service after 1st April 2025.

- To Fill out the required details and submit it.

FAQ’s About Unified Pension Scheme 2025

When will be the UPS scheme come into effect?

The UPS scheme will come into effect from the 1 April 2025.

What will be the lock period of UPS?

UPS requires a minimum of 10 years of the qualifying service to be eligible for the assured payouts. Partial withdrawals may be permitted after a three-year lock-in period under to the specific conditions.

Will I withdraw money from the UPS before the retirement?

UPS is a long-term retirement benefit scheme, focused on providing to the financial security after the retirement . Employees can however make the partial withdrawals up to three times during their service, following a 3-year lock-in period.

Each withdrawal can be up to 25% of the employee’s contributions and is only allowed under the specific circumstances, like home purchase, children’s education/marriage, medical expenses, or skill development. Complete withdrawal before the retirement isn’t allowed.

What will be the last date for switch the Unified Pension Scheme (UPS)?

The last date to exercise the option for the UPS or switch to UPS from NPS is 30th September 2025.