PAN Aadhaar Link Online 2026: The Permanent Identity Number (PAN) and Aadhaar card are the important documents for every Indian citizen. While the Income Tax Department (IT) issues the PAN cards, the Unique Identification Authority of India (UIDAI) issues Aadhaar cards.

PAN is a unique identification number given to the individuals and businesses for the tax purposes. Aadhaar number is a unique 12-digit number that is assigned to every Indian resident. However, the IT department has made it mandatory to link the PAN and Aadhaar cards.

PAN Aadhaar Link 2026

The Income Tax Department has enforced mandatory Aadhaar-PAN linking due to growing concerns over misuse and tax evasion. Authorities uncovered several incidents where people possessed more than one PAN card or used someone else’s PAN credentials to dodge taxes.

The Indian tax laws require the PAN Aadhaar linking. Failure to do so can block your Permanent Account Number (PAN), causing severe inconveniences in filing taxes, payment of refunds and monetary transactions.

The Central Board of Direct Taxes (CBDT) recently released a new direction of individuals that got their PAN by utilizing an Aadhaar enrolment ID instead of their actual Aadhaar number to fill the Aadhaar PAN linking.

In the scenario of the Income Tax Act, Section 139AA(2A) provides that all individuals who have been assigned PAN on 1st July 2017 and are eligible to be given Aadhaar number must link the two in the prescribed manner.

This Indian citizens that submit income tax returns, invest in financial instruments, or high-value financial transactions. To everyone else, failure to carry out the Aadhaar PAN linking procedure will mean that their PAN will be inoperative, and they will not access tax and financial services.

SSO Rajasthan Portal- Rajasthan SSO ID Login Registration 2026

JN Tata Endowment Loan Scholarship 2026 Online Application, Last Date 15th March

PAN Aadhaar Link Online Process

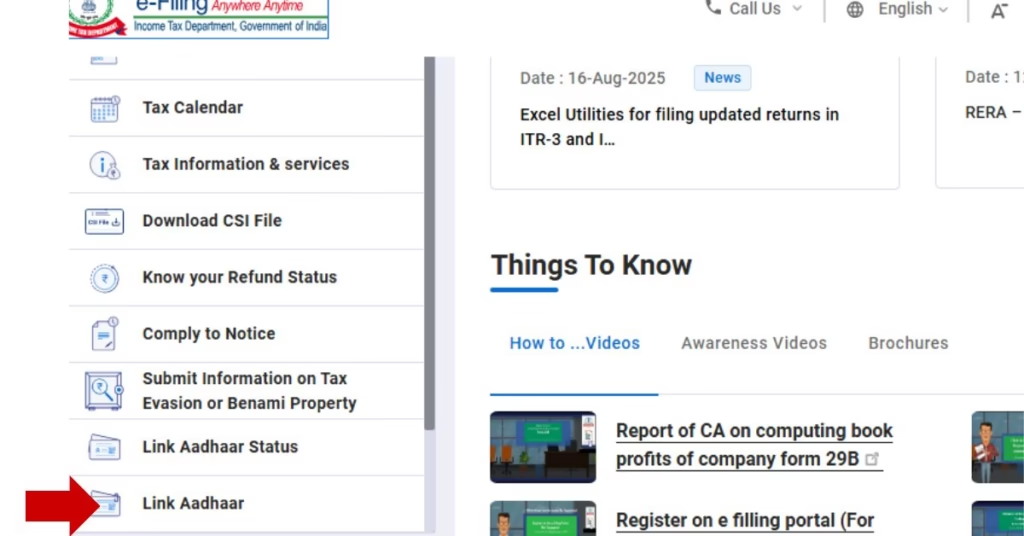

- Visit the link official website of incometax.gov.in/iec/ of the Income Tax.

- After that, below the ‘Quick Links’ tab you have to choose to the ‘Link Aadhaar’ option.

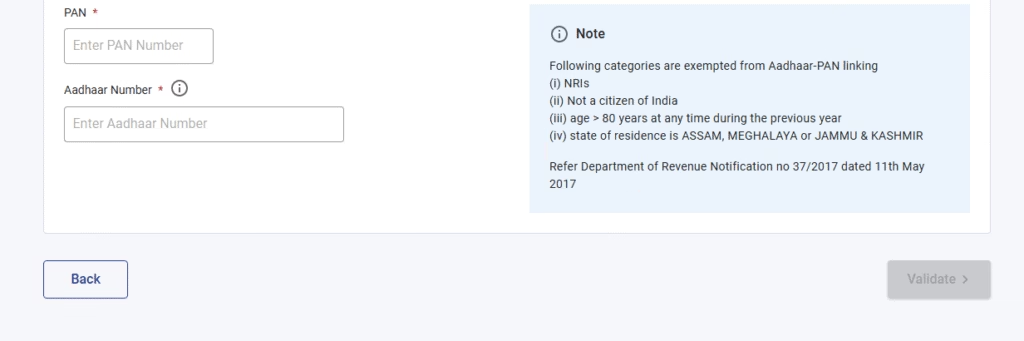

- After that, you have to fill in the complete information such as PAN Number, Aadhaar number, Name as printed on Aadhaar card, and valid mobile number.

- Now, if the birth year is printed on the Aadhaar card you have to choose the square box and if you are agree to get your Aadhaar details verified then click the other box and then select on the ‘Link Aadhaar’ option.

- After filling in the Captcha code, you will get an OTP on your registered mobile number.

- After this, you have to hit the ‘Validate’ tab.

Offline Method 1: Linking via SMS

- Open the SMS app on your phone.

- Enter the text as follows; UIDPAN <12-digit Aadhaar> <10-digit PAN>.

- Send the SMS to either 567678 or 56161.

Cost: NSDL and UTI do not charge anything on this service, though, the standard SMS charges in your mobile operator will be charged.

Offline Method 2: Service Centre Linking Manually

In case your online or SMS requests continue to fail because of a “Data Mismatch” (i.e. your name is spelled incorrectly or your photo has become old), then you need to utilize the physical method of the “Annexure-I” method.

- Visit to a specific PAN service centre run by either NSDL (Protean) or UTIITSL.

- Request and complete the ‘Annexure-I’ form which is specifically designed to be used in case of PAN-Aadhaar linking.

- Be sure to bring documents that are self-attested copies of your PAN card and Aadhaar card.

- In case you have significant error in your information, the authorities will carry out a Biometric Authentication (fingerprint scan or iris scan) to verify your identity.

Importance of PAN Aadhaar Link

PAN-Aadhaar connection is a crucial move towards ensuring the integrity of the Indian financial system. The PAN card is the financial identification of a person and the government is able to keep track of the tax filing, source of income and even high-value transactions. Aadhaar is on the other hand the most credible identity database in India. When the two are linked, it will avoid the abuse of duplicate PANs and transparency in the collection and reporting of taxes.

Consequences of PAN Aadhaar Link

When a PAN card is rendered inactive, it has a much greater effect than filing taxes. You will not be able to specify or confirm income tax returns, renew bank KYC or transact on certain financial activities. There are a great number of services that need an authentic PAN such as applying credit cards, buying or selling property, etc. In the case of the businesses, it has the potential of disrupting payments, compliance filings, and vendor transactions, resulting in delays in operations.

If you come in this category, check your PAN Aadhaar link status now, complete the linking process online. You should keep in mind that to link your PAN and Aadhaar card you have to pay Rs. 1,000 as fine.

What will Happen if your Don’t Link PAN with Aadhaar

if your Don’t Link PAN with Aadhaar PAN Becomes Inoperative: You can not submit income tax returns (ITRs), get tax refund, and transact any business where quoting of PAN is required.

Higher TDS/TCS Deduction: Section 206AA and 206CC of the act of income tax provide that where PAN was not provided, or was inoperative, the TDS/TCS would be deducted at a higher rate.

Disrupted Form Submissions: Forms such as Form 15G/15H, which require non deduction of TDS, will not be accepted.

KYC and Service Restrictions: Bank, mutual funds and stockbrokers may withhold services like investments, redemptions or opening of new account because of invalid KYC.

Compliance Penalties: Renewing PAN after the end of the deadline consists of payment of fine 1000 and it might need verification procedures.

Non-Processing of Refunds: There will not be issued any refunds on an inoperative PAN, nor are any interest on such refunds likely to be issued.

To prevent such inconveniences, it is important to check whether you are linked to PAN Aadhaar and take action in case you are yet to do so.