New IRS Tax Brackets 2026: A key update that impacts on millions of taxpayers occurred unobtrusively as the government shutdown and IRS furloughs dominated the news. The federal income tax bracket 2026 that has been issued by the IRS includes inflation adjustments. These changes may not be as large as they used to be in previous years; however, they present significant relief in taxes to many Americans who are currently struggling in terms of increased living expenses.

You can file singly as the head of household or file them jointly with your married partner, but having known these new brackets and deductions better assists you in making a better strategy of how to file the 2026 taxes.

What Are New IRS Tax Brackets 2026?

The tax brackets categorize your income into various tax brackets that are levied at varying rates 10, 12, 22 etc. These brackets are updated each year by the IRS according to inflation based on the Consumer Price Index.

This avoids the problem of bracket creep where inflation would push your income to higher tax brackets without any justification. Compared to the past years, the 2026 adjustment is not huge, but it still implies that you can pay less tax or that you will be a bit less liable the next year.

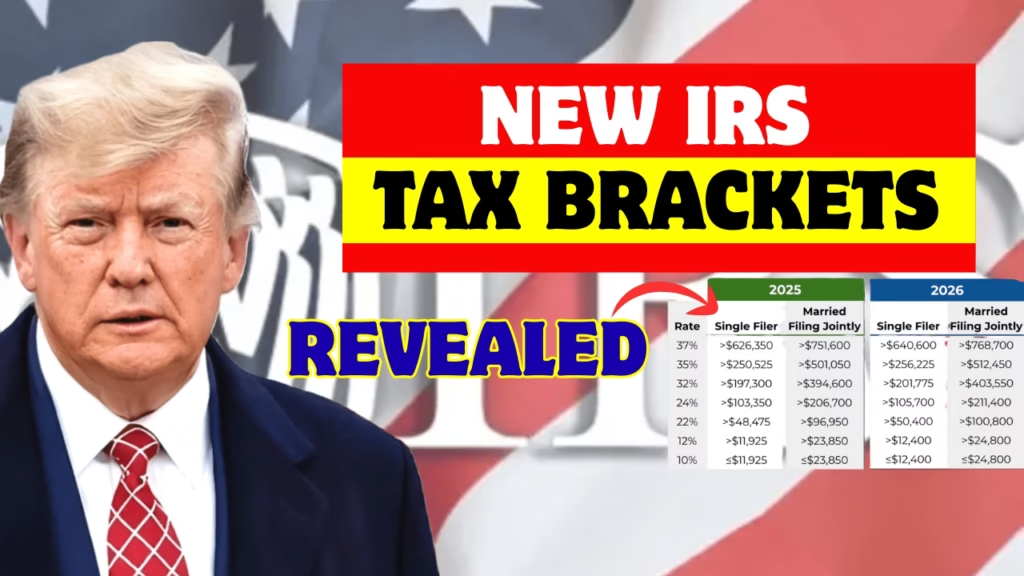

New 2026 Tax Brackets of Individual Filers

The following are the revised single filer income range with marginal tax rates through to 2026:

- 10%: $0 to $12,400

- 12%: $12,401 to $50,400

- 22%: $50,401 to $105,700

- 24%: $105,701 to $201,775

- 32%: $201,776 to $256,225

- 35%: $256,225 to $640,600

- 37%: $640,601 and higher

The bottom of the 10 percent range increased by 3.9 percent by increasing it to $12,400, up to $11,925. The hurdle to the peak of 37 percent rate raised approximately 2.3 percent between $626,351 and 640,601.

3 Secret Social Security Rules Every Retiree Needs to Know, Don’t Make These Mistakes

Medicare Premium Hike 2026 Announced: Why Social Security Dual Enrollees Will Pay More

New 2026 Tax Brackets of the Married Couples Filing Jointly

The bracket of married couples filing together is also increased:

- 10%: $0 to $24,800

- 12%: $24,801 to $100,800

- 22%: $100,801 to $211,100

- 24%: $211,401 to $403,550

- 32%: $403,551 to $512,450

- 35%: $512,451 to $768,700

- 37%: $768,701 and up

The 10 percent bracket increased by 3.9 percent to 24800 and the 37 percent bracket raised by 751600 to 768700.

Who Stands to Gain the Most by these Updates?

The immediate saving is reflected on low and moderate income taxpayers that claim the standard deduction. Families having children will be allowed to claim greater earned income credits. Elderly individuals enjoy the new additional deduction. The people who are near the tax bracket edges might not be willing to spill to the increased rates because of inflation levies.

What These Changes Do Not Encompass?

The 2 to 4 percent inflation adjustment would not necessarily apply to all people- particularly those whose salary growth rate exceeds the inflation rate or people who live in urban areas with high cost of living. There are other tax law changes, personal deductions, and credits which influence the final taxes owed.

US $4873 November 2025 Direct Deposit Update: Check Eligibility & Full Payment Schedule

Singapore Workfare Income Supplement 2025: Who Qualifies and When You’ll Receive Your Payment?

How to Prepare for Your 2026 Taxes?

Check the brackets and deductions in the new taxes as you intend to save. Establish whether you are eligible to new or more tax credits. Plan timing revenue or deductions in order to regulate tax brackets. Modifications that impact on your personal finances should be consulted with a tax advisor. Use new tax programs based on 2026 IRS regulations.

The change of the IRS 2026 tax bracket is a gradual relief to the taxpayers who suffered significant increases in the previous years. Large deductions and credits will allow you to stretch your income as costs go up. By remaining current and planning ahead you will be able to take full advantage of these changes to lower your tax bill.